Brentford Financial Results 2024/25

- Matchday Finance

- 15 hours ago

- 13 min read

The 2024/25 campaign marked the 135th season in Brentford’s history and their fourth consecutive year in the Premier League.

On the pitch, 2024/25 was another strong season for the club, finishing 10th—just one place below their best-ever Premier League finish in 2022/23. It also marked the final season under Danish head coach Thomas Frank, who departed for Tottenham after seven years in charge. During his tenure, Frank guided Brentford from the Championship

to becoming a highly respected Premier League side.

This achievement is particularly impressive given the club’s player budget. Across the last seven seasons, Brentford have outperformed relative to their playing budget, often by a considerable margin. In 2024/25, for example, Brentford’s staff costs ranked an estimated 19th in the league, making their 10th-place finish a notable success.

Brentford have been owned by lifelong supporter and professional gambler Matthew Benham since his acquisition of the club in 2012, at a time when it was in financial distress. While Benham has retained overall control, the club welcomed new minority investors after the 2024/25 financial year, with philanthropist Gary Lubner and film director Sir Matthew Vaughn joining the shareholder base. In addition, Bees United, the supporters’ trust, continues to hold a ‘special share’, ensuring fan representation at board level.

Brentford are something of an outlier in the Premier League, having largely operated under a self-funded model. Owner Matthew Benham’s total investment is around £100 million — significantly lower than that of many other Premier League owners, notably Tony Bloom at Brighton and Bill Foley at Bournemouth. To put this in further perspective, it is also lower than the level of funding seen at several Championship clubs, including Bristol City and even Preston North End.

There has, however, been a slight shift in 2024/25, with the club reporting its largest loss in recent years and requiring additional external funding for the first time in four seasons. This is unlikely to concern supporters significantly, as the team is enjoying another strong campaign and currently sits in 8th place. The performance is particularly impressive given the leadership change following seven years under Frank, as well as the departure of key attacking players Wissa and Mbeumo at the start of the season.

Financial Results 2024/25

Financial highlights:

Revenue: Total revenue reached a record £173 million, up £6 million on the previous year, driven mainly by a higher league finish (10th vs 16th) and modest growth in matchday income.

Staff costs: Following significant player acquisitions, wages and salaries rose sharply by £17 million to £131 million. Player amortisation also increased, rising from £36 million to £48 million in 2024/25. Total staff costs reached £179 million, though this likely remains one of the lowest cost bases in the league.

Player sales: The club generated £27 million from player sales, primarily from Ivan Toney’s transfer to Al-Ahli.

Profit/loss: The club reported its largest loss in recent years, posting a £21 million deficit compared with an £8 million loss the previous season, mainly due to higher staff costs.

Net assets: Net assets fell to £60 million following a £40 million increase in external loans used to fund player acquisitions.

Player trading: Brentford spent a club-record £100 million on new players — likely the 13th highest spend in the league — with Thiago, Sepp van den Berg, Carvalho, Kayode, Kelleher, Nunes, and Meghoma joining the squad. This was partially offset by £36 million in player-sale income, primarily from Ivan Toney.

Loans and debt: External loans increased by £40 million, lifting total debt to £130 million. Transfer-related debt also rose, with a net balance of £61 million following record investment in players.

Cash Flow: The club generated £2 million in operating cash flow and recorded a net investment outflow of £40 million. The resulting cash shortfall was funded through increased borrowings of £40 million.

Financial Outlook

Competing in the Premier League represents a significant challenge for smaller clubs, particularly when operating with a staff budget — as in Brentford’s case — that is roughly a third of those of the league’s largest clubs. Brentford have arguably managed this balancing act better than almost anyone, but cost pressures are beginning to build. In 2024/25, staff costs exceeded turnover for the first time, highlighting the growing financial strain required to remain competitive.

That said, the club appears well positioned for the medium term. Around £100 million in transfer profit is already effectively secured for the current season following the sales of Wissa and Mbeumo. Also. the new Premier League broadcast cycle, with higher international rights income, will increase revenue for all clubs. So, there is potential for a further revenue increase this season, particularly if their current form continues.

In addition, Matthew Benham’s shareholder restructuring — which has introduced new investment from Gary Lubner and Sir Matthew Vaughn — strengthens the ownership base and provides additional strategic flexibility.

Turnover

Revenue is generated from three primary streams: matchday income (ticket sales), broadcasting distributions (from the Premier League and, where applicable, UEFA competitions), and commercial activities, including sponsorships, merchandising, and other business operations.

The 2024/25 season marked a record year for the club, with a strong league finish driving total revenue to £173 million.

With only four clubs having published their financial accounts to date — Brentford, Brighton, and the two Manchester clubs — the chart below compares their reported figures with estimated revenues for the remaining teams. Our analysis indicates that Liverpool generated the highest revenue in the 2024/25 season, while Brentford ranked 17th, ahead of only the three relegated clubs.

Matchday Revenue

Matchday revenue is influenced by several factors, including the number of home fixtures, average attendance, ticket pricing, and a club’s ability to maximise income from hospitality and corporate boxes. One key exception is domestic cup competitions, where gate receipts are shared between the participating clubs and the FA.

Brentford have played at the Gtech Community Stadium since 2020. With a capacity of 17,250, it is the second-smallest ground in the division. During the 2024/25 season, as with all Premier League clubs, every league fixture was sold out, with Brentford averaging 17,185 supporters per match. The club also reported 93% occupancy across league fixtures, reflecting the fact that not all season ticket holders attend every match. Brentford have actively sought to ensure seats are filled, operating a ticket exchange system that allows season ticket holders to resell their seats — a model that benefits both supporters and the club.

The team played one additional domestic cup match compared to the previous season, increasing total attendance figures. Combined with season ticket price rises, which lifted revenue per fan by 5% to £33.80, overall, matchday revenue reached £12.4 million, up £1.1 million on the previous season.

While the table below incorporates estimates for clubs that have yet to publish their accounts, Brentford’s matchday revenue is projected to rank 18th in the league.

As things stand, Brentford have no confirmed plans to expand the Gtech Community Stadium.

Broadcast Revenue

Broadcast revenue is generated primarily through central Premier League distributions, UEFA payments from European competitions — not yet applicable to Brentford — and the club’s own media activities.

The 2024/25 season marked the third and final year of the Premier League’s current broadcast cycle, with total distributions broadly consistent with 2023/24 levels. Approximately 67% of broadcast income is shared equally among clubs, with the remainder allocated through merit payments based on league position and facility fees linked to the number of live televised matches.

Brentford’s tenth-place finish led to an increase in Premier League distributions, rising from £124 million to £139 million.

The chart below shows the club by club distributions published by the premier league.

For reference, the chart below shows total estimated broadcast revenue, including Premier League distributions, UEFA payments, and income from the recently expanded FIFA Club World Cup, which was contested only by Chelsea and Manchester City. The comparison underscores the substantial financial benefits of participating in these competitions, with Champions League involvement alone capable of generating revenues exceeding £100 million.

Commercial Revenue

In 2024/25, Brentford grew their underlying commercial revenue by £3 million, reaching £19.4 million. However, “other” revenue fell sharply from £11.6 million to £1.7 million, as the previous season included loan fee and salary recovery income from David Raya’s loan at Arsenal prior to his permanent transfer.

Reflecting the owners’ background, Brentford — like ten other Premier League clubs — partnered with the betting industry, with Hollywoodbets continuing as the front-of-shirt sponsor in 2024/25. However, clubs will need to seek partners from other industries next season, as the display of betting company names on shirts is now banned.

Other key commercial partners for 2024/25 included Umbro as kit supplier, Pension Bee as sleeve sponsor, and a ten-year stadium naming rights deal with GTech. Collectively, these partnerships are estimated to be worth over £10 million per year.

While Brentford’s commercial revenue in 2024/25 set a club record, it likely ranks around 18th in the Premier League. As the chart below illustrates, the “big six” remain on an entirely different scale, although Newcastle and Aston Villa have seen significant growth following their recent entries into the Champions League.

Staff Costs

Staff costs include salaries and wages for all employees, the amortisation of transfer fees (spreading a player’s acquisition cost over the length of their contract), and any impairments, which arise when a player’s estimated market value falls below their book value.

Salaries and wages rose sharply from £114 million to £131 million following Brentford’s largest-ever recruitment spend. While this represents a club record, it still likely ranks among the lowest salary budgets in the Premier League outside the relegated clubs, underscoring the team’s strong performance relative to their resources.

Record spending on players also had a significant impact on amortisation. With over £100 million invested in transfers, amortisation rose from £36 million to £48 million, though this remains among the lowest in the league.

Based on our estimates, the chart below compares Brentford’s total staff costs with those of other Premier League clubs. Among the clubs that have published accounts, Brentford’s spending is £70 million lower than Brighton’s and roughly a third of that of the two Manchester clubs.

Although Brentford’s staff costs remain among the lowest in the league, for the first time since their return to the Premier League they exceeded turnover, reaching 103% (note that we expect more than half of Premier League clubs will have a ratio above 100%). This places pressure on profitability and highlights the need for clubs to sell players to mitigate losses.

Profit on Player Sales

Since returning to the Premier League, Brentford have generally not relied heavily on player sales to support profitability. However, there have been a few high-profile departures in recent seasons, including David Raya’s sale to Arsenal following an extended loan, and in 2024/25, Ivan Toney’s transfer to Al-Ahli. This season also saw the exits of two key strikers, with Bryan Mbeumo moving to Manchester United and Yoane Wissa joining Newcastle; any profit from these sales will be reflected in the 2025/26 accounts.

Profit for 2024/25 was £27 million, primarily driven by Toney’s sale.

Profit on player trading will increase significantly in 2025/26, as the departures of Mbeumo and Wissa are projected to deliver approximately £110 million in transfer income against a combined acquisition cost of only £16 million.

Squad Cost Ratio

The Premier League will introduce a new set of financial rules starting in the 2026/27 season, replacing the existing Profitability and Sustainability Rules (PSR). A key metric under the new framework is the Squad Cost Ratio, which limits Premier League clubs’ on-pitch spending to 85% of their football-related revenue, including net profit or loss from player sales.

This measure accounts only for players and coaching staff costs while including profits from player sales in revenue. Although clubs rarely report “football-only” staff costs, we estimate Brentford’s Squad Cost Ratio at approximately 73% (assuming 75% of total staff costs are football-related), comfortably within Premier League limits.

Profit and Loss

Brentford reported a loss of £20.5 million for the year, down from a £7.9 million loss in the previous period. Despite this, the club remains in overall profit since returning to the Premier League, recording a combined £11 million surplus across the past four seasons. In a league where sustained profitability is rare, this is a particularly impressive achievement. It has been driven primarily by disciplined wage control, strong recruitment, and well-timed strategic player sales.

In 2024/25, total revenue of £173 million increased by £7 million year-on-year, while wage costs rose by £16 million. As a result, EBITDA (earnings before interest, tax, depreciation and amortisation) fell by £5 million to £11 million.

After accounting for £59 million of player amortisation and depreciation, the club reported an operating loss of £49 million. While this appears significant, operating losses are common across the Premier League — Brighton, for example, recently reported an operating loss in excess of £100 million.

The operating deficit was partially offset by £27 million of profit on player sales and an £8 million gain on the disposal of fixed assets, relating to a settlement on a property interest. This reduced the overall net loss to £20.5 million, £13 million higher than the previous season.

As noted, only three other clubs have published their results so far, and none have reported a profit. Manchester City recorded the smallest loss at £10 million, while Brighton posted a £56 million deficit, following two seasons of record profits.

Net Assets

Net assets represent the difference between total assets and total liabilities and correspond to the club’s net equity.

Assets include fixed assets—such as player registrations, facilities, and goodwill—as well as current assets like trade debtors, transfer fees receivable, and cash.

Liabilities comprise loans (from banks, shareholders, or group companies), transfer fees payable, trade creditors, deferred income (for example, advance season ticket sales), and other financial provisions.

The 2024/25 season saw increases in both total assets and liabilities at Brentford. Investment in the playing squad drove player assets up by more than £45 million to £182 million. On the liabilities side, the club took on an additional £35 million in loans, while outstanding transfer fees rose by £36 million to £97 million.

The net result is that Brentford now report net assets of £60 million, down from £78 million in the previous season.

The table below sets out the latest available net asset positions of Premier League clubs. It is important to note that a club’s net asset position is heavily influenced by its funding structure, particularly among challenger clubs. For example, Aston Villa and Newcastle have both been supported through significant equity injections, which explains their positive net asset positions, whereas Brighton have been funded primarily through debt from their owner Tony Bloom.

There are several balance sheet–related measures within the Premier League’s new financial regulations, which come into effect next year. These fall under the Sustainability and Systemic Resilience (SSR) framework and include:

Working Capital Test

This assesses a club’s immediately available cash headroom over the course of a season. Clubs must maintain at least £12.5 million in short-term liquid assets.

Liquidity Test

This examines medium-term resilience and a club’s ability to withstand financial shocks, such as relegation. A club must demonstrate that its liquid assets, less liquid liabilities, plus 40% of squad market value, exceed £85 million. In practical terms, this reflects whether a club could cover short-term obligations by selling part of its squad if required.

Positive Equity Test

This measures long-term financial health. It includes the full squad market value (or net book value, if higher) as an adjusted asset. Total liabilities must not exceed 90% of adjusted assets, tightening to 80% by 2028/29.

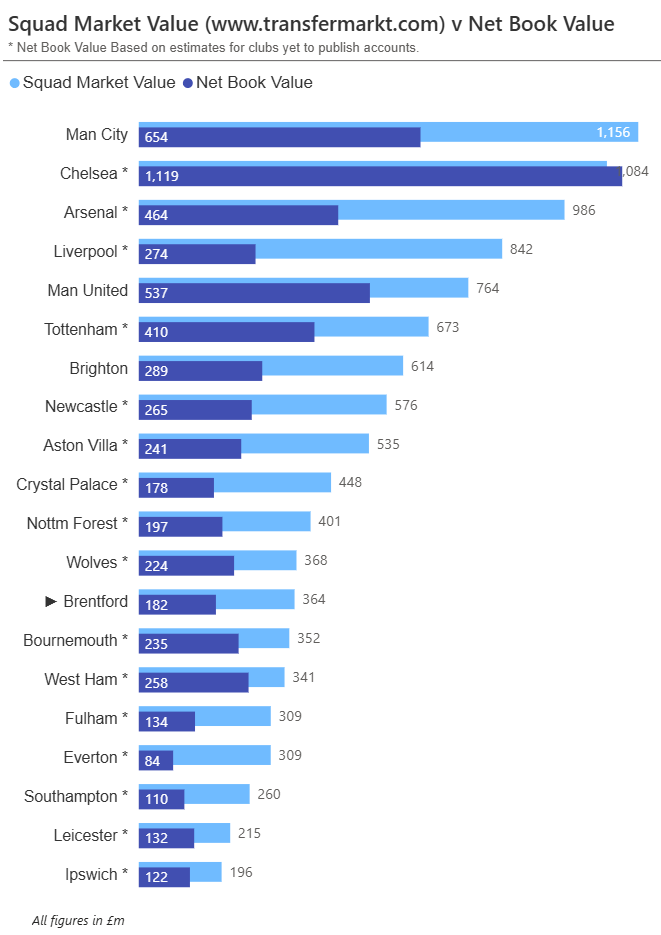

Brentford appear well positioned across these tests and maintain relatively low levels of debt. For example, their estimated Positive Equity Test ratio is around 56% (see calculation below).

The club reports total assets of £374 million. Based on Transfermarkt estimates, the squad’s market value of £363 million is £181 million higher than its book value, resulting in adjusted assets of approximately £555 million. With total liabilities of £314 million, this equates to 56% of adjusted assets — comfortably within Premier League limits.

Player Trading

Brentford spent a club-record £100 million on new signings in 2024/25. Major arrival included: Igor Thiago from Club Brugge, Sepp van den Berg from Liverpool, Fábio Carvalho from Liverpool, Michael Kayode from Fiorentina, Caoimhin Kelleher from Liverpool, Gustavo Nunes from Grêmio Foot-Ball Porto Alegrense and Jayden Meghoma from Southampton.

The club recouped £36 million, largely through the sale of Ivan Toney to Al-Ahli.

While the £100 million spend set a club record, it ranks only 13th highest in the Premier League based on our estimates. After factoring in player-sale income, Brentford’s net transfer spend of £64 million is likely the tenth highest in the league.

Squad

Like Brighton and Bournemouth, Brentford have shown exceptional recruitment, increasing the market value of their squad to around £360 million at the end of the 2024/25 season (per Transfermarkt).

While the club’s net book value of players — the acquisition cost minus accumulated amortisation — was £182 million. The gap between market value and net book value indicates the potential for generating profits from player sales. Brentford clearly tapped into this post-season with the sales of Mbeumo and Wissa.

The chart below compares squad market value and net book value for all Premier League clubs at the end of 2024/25. Chelsea is the only club whose net book value exceeds its market value.

Football Net Debt

As illustrated below, up to the 2022/23 season, Brentford’s debt consisted mainly of shareholder loans totaling around £60 million. Over the past two seasons, the club has added a £44 million bank loan and a £26 million overdraft, primarily to fund player acquisitions.

Of the shareholder loan, £22 million relates to the stadium project and is interest-free, while the remainder carries a discounted rate of 12.5%.

In July 2025 (post these accounts), the Club entered into a new £100m interest-bearing facility with Macquarie Bank, comprising a £75m Term Loan and £25m Revolving Credit facility. The overdraft was repaid on completion of this refinancing process.

Debt across the Premier League reached £3.6 billion in the 2023/24 season, consisting of £2.4 billion owed to third parties and £1.2 billion to related parties. Everton recorded the highest overall debt, although much of its related-party borrowing has since been converted into equity. Brentford’s debt ranks as the tenth highest in the league.

Following Brentford's record spending on players, it is unsurprising that transfer-related debt rose sharply. It is standard practice for clubs to agree payment schedules for transfers that are spread over multiple years.

In 2024/25, transfer fees payable increased by £36 million to a club record £97 million, while transfer fees receivable fell to £36 million, down from £44 million the previous season.

As a result, net transfer debt reached £61 million, an increase of £44 million from the previous season.

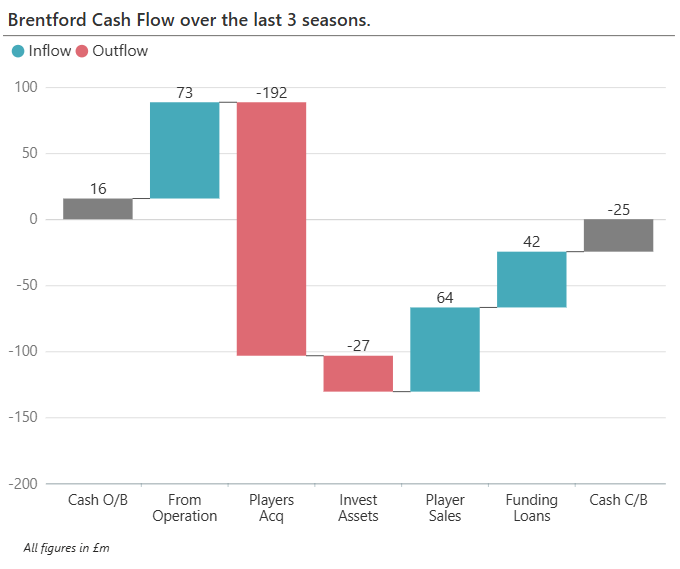

Cash Flow

Cash Flows are reported in three categories:

Cash Flows from Operations refer to cash generated from the club’s core activities—revenue minus day-to-day costs such as salaries, rent, and utilities.

Cash Flows from Investments include cash spent on player acquisitions and facility improvements, net of player or asset sales.

Cash Flows from Financing cover new loans or equity raised, less repayments or buybacks. If operational cash flow cannot fund investments, the shortfall is usually met through financing.

Cash flows can fluctuate significantly from year to year. Looking over the last three seasons, the club has generated £73 million in operational cash flow, supported by relatively low staff costs compared with revenue. During this period, the club invested £172 million in the squad and £27 million in other assets, while receiving £64 million from player sales.

To fund the resulting gap, external loans increased by £42 million, with the remainder covered through a £25 million overdraft facility and existing cash reserves.

It is also worth noting that Benham provided a £23 million loan during the season to support working capital, which was fully repaid before the year end.

Reporting Entity

This analysis is based on Brentford FC Limited, owned by Matthew Benham through his company Best Intentions Analytics Ltd. On 15 July 2025, new shares in Best Intentions Analytics Ltd were issued to two new minority shareholders, Gary Lubner and Sir Matthew Vaughn effectively making them minority owners of Brentford.

Comments