Derby County Financial Results 2024/25

- Matchday Finance

- Dec 2, 2025

- 9 min read

Updated: Dec 26, 2025

The 2024/25 campaign marked the 126th season in Derby County’s history and their first year back in the Championship following promotion from League One in 2023/24.

Derby County’s recent history has been shaped by a dramatic collapse, and a period of recovery. After several years of heavy spending under former owner Mel Morris in an effort to reach the Premier League, the club’s finances deteriorated, and breaches of accounting rules left Derby facing major sanctions. They entered administration in 2021, received a 21-point deduction, and were relegated to League One.

The crisis ended in 2022 when local businessman David Clowes purchased both the club and Pride Park, stabilising operations and allowing a reset on and off the pitch. The company stated that they considered the potential liquidation of the local football club was not in the best interests of the company or those of the city of Derby and could not stand by and let the club fail.

Since the takeover, Clowes’ company has provided £63 million in loans to the club. These funds were used both to bring Derby and its associated companies out of administration and to support ongoing operational needs.

Under Paul Warne, Derby achieved promotion back to the Championship in 2023/24. In their first season back, the club maintained a mid-table position for the first half of the campaign. However, a poor run of form—just two points from 12 matches—saw them slide into the relegation zone, leading to Warne’s replacement by John Eustace. Eustace guided the team to safety with six wins in the final eleven games, securing a 19th-place finish on the final day.

Entering their second Championship season, Derby are, at the time of this report, sitting in a respectable 10th place. While the club continues to incur losses—albeit at levels typical for the Championship—ongoing funding remains necessary. Nevertheless, the club is now operating under a more cautious and sustainable model as it continues its long-term rebuild.

Due to the financial collapse of the club, and subsequent administration, there were no published accounts between season 2018/19 and 2021/22.

Financial Results 2024/25

Derby County are one of only two Championship clubs to have published their financial results, the other being Norwich City.

Financial highlights:

Total revenue increased from £19.4 million to £31.9 million, following promotion from League One.

All revenue streams increased; matchday up £2 million, broadcast up £9 million and commercial up £1.5 million.

Salaries and wages rose from £22 million to £31.5 million while player amortisation increased to £2.2 million.

Total staff costs reached £33.7 million, equivalent to 105% of turnover.

The sale of Eiran Cashin to Brighton generated £10.3 million in profits.

Losses reduced from £14 million in 2023/24 to £11 million in 2024/25.

Net liabilities amounted to £44.9 million, mainly due to £63 million owed to Clowes.

The club spent £12 million on new signings, with Norway’s Sondre Langås the most expensive purchase.

This was largely offset by £11 million received from the sales of Cashin.

The amount owed to Clowes stood at £61.5 million, up £14.6 million.

Operating cash flow was negative £17.1 million funded by the loan increase from Clowes.

Financial Outlook

Off the pitch, Derby’s operating income and costs for 2025/26 are expected to remain broadly in line with 2024/25. However, with no significant player sales so far, losses are currently forecast to rise. As a result, additional owner funding in the region of £20–25 million is likely to be required.

Turnover

Key revenue sources include matchday income (ticket sales), central broadcasting distributions from the EFL, Premier League solidarity payments, and commercial income such as sponsorships, merchandising, and other business activities.

All revenue streams grew in 2024/25 following the club’s promotion from League One.

Derby have the potential to regain the stature they once enjoyed. In terms of revenue, they would be positioned in the top half of Championship clubs. With only Derby and Norwich having published their 2024/25 results to date, the chart below compares their figures with other clubs’ 2023/24 revenue.

Matchday Revenue

Matchday revenue is influenced by factors such as the number of home games, average attendance, ticket prices, and income from hospitality events and corporate boxes. The only exception to this is domestic cup matches, where revenue is shared between the clubs and the FA.

Pride Park Stadium, Derby County’s home since 1997 following their move from the old Baseball Ground, has a capacity of 33,600. In the 2024/25 season, the club averaged 29,018 spectators per league match, filling 96.5% of the stadium—an increase of 6.4% on the previous season and the third-highest average attendance in the Championship. Just over 22,000 supporters held season tickets, representing 76% of matchday attendees.

Following promotion, Derby’s average revenue per fan rose 20% to £14.20, still below the 2023/24 Championship average of £15.56 and the club played the same number of home league matches as the previous season (excluding EFL Trophy fixtures). Overall matchday revenue increase from £7.6 million to £9.6 million which, based on 2023/24 figures, would have ranked ninth highest in the league.

Broadcast Revenue

Broadcast income comes from EFL central distributions and Premier League solidarity payments. An uplift in EFL TV rights last season increased central distributions to £5.4 million per club, with solidarity payments estimated at £5.3 million. Derby's total media revenue for the year was £12 million — an increase from the £2.9 million earned in League One.

Commercial Revenue

Commercial revenue increased from £8.9 million to £10.3 million, though it remains below the £11.8 million recorded in 2017/18, the last season before administration.

Sponsorship contributed £2 million, while hospitality, catering, and events generated £6.7 million, with the remainder coming from other commercial activities. Football fan loyalty company FanHub serves as the club’s front-of-shirt sponsor, and Puma is the official kit manufacturer.

Based on 2023/24 figures, this would have placed Derby 12th in the Championship. For comparison, Norwich City—the only other club to have published 2024/25 results—reported commercial revenue of £15.3 million, including £4.3 million from sponsorship, compared with Derby’s £2 million.

Staff Costs

Staff costs include salaries and wages paid to all employees, the amortisation of transfer fees (spreading the cost of a player’s acquisition costs over the length of their contract), and any impairments (incurred when a player’s estimated current market value falls below their book value).

Salaries and wages rose from £22 million to £31.5 million, reflecting the expected increase following promotion from League One. Despite this rise, they remain well below the £46.8 million reported in the last published accounts before administration.

Amortisation increased modestly from £0.3 million to £2.2 million following £12 million in player investments; however, this remains relatively low compared with typical Championship club levels.

Comparing total staff costs to other clubs (using 2023/24 results except Norwich) the chart below shows their staff costs were less than a quarter of the three big clubs, Leeds, Leicester, and Southampton, and would rank 14th in the division. Not excessive by Championship standards but would suggest a 19th place finish was below par for the club.

The club’s total staff costs amount to 105% of revenue. Again, comparing this to 2023/24 results, it was well below the league average of 122% (16 Championship clubs had staff-to-revenue ratios exceeding 100%). It still presents profitability challenges. as the club will make losses unless they sell players profitably.

Profit on Player Sales

The club generated £10.3 million in profits from player sales, the highest amount since they resumed publishing accounts. This was mainly due to the sale of academy graduate Eiran Cashin to Brighton.

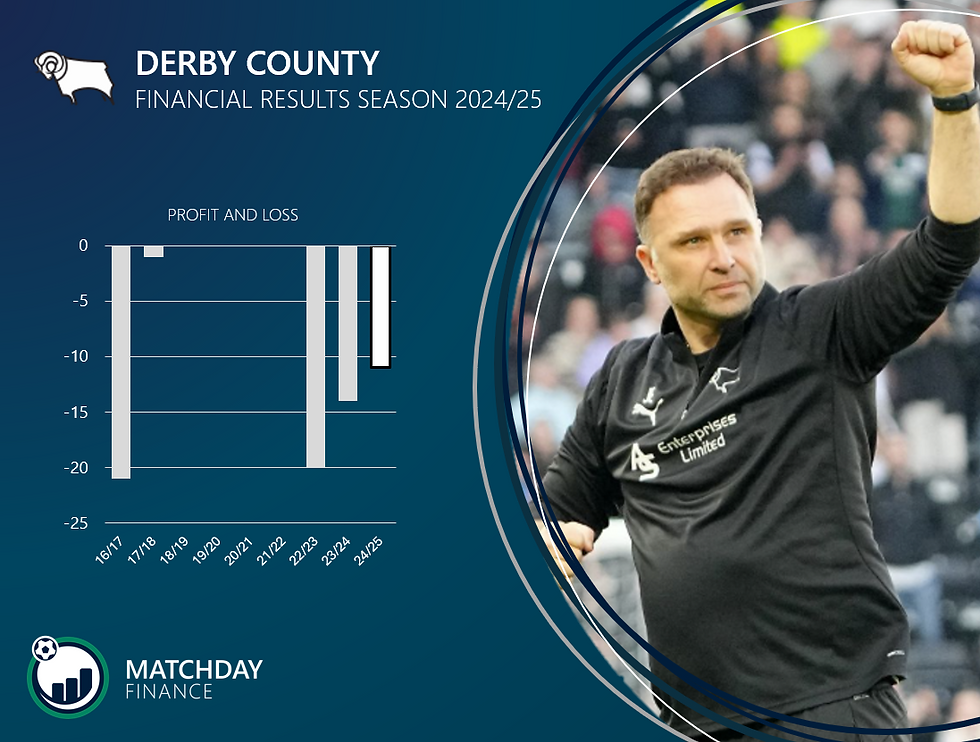

Profit and Loss

When Clowes Development acquired the club, their message centered on stability, integrity and progress. There is no doubt progress has been made, with Derby sitting mid-table in the Championship at the time of this report. The financial results for the three seasons since the takeover show cumulative losses of £46 million, which are broadly in line with the typical financial profile of a Championship club. In 2023/24, for example, the average loss across the division was £13.2 million. This underlines the level of funding required to compete at this level.

Like many Championship sides, the club’s business model is to operate within the EFL’s Profit and Sustainability limits, accepting controlled losses in the hope of one day becoming the next Bournemouth or Brentford. Profitable player trading will also likely play an important part in easing the financial burden.

In 2024/25, Derby’s operating costs—covering salaries, wages and day-to-day expenses—were 154% of revenue, producing an EBITDA loss of £17.5 million. Player amortisation and depreciation added a further £4.9 million, taking the operating loss to £21.4 million. This was partially offset by £10.3 million in profit from the sale of Eiran Cashin, resulting in a total loss of £11 million, the smallest of the three seasons since the takeover.

These losses must be funded by the owners and kept within the EFL’s Profitability and Sustainability rules, which allow adjusted losses of up to £13 million per year over a rolling three-year period. Adjustments are made for spending on areas such as youth development, women’s football and infrastructure.

Derby are one of the few clubs that publish their adjusted figures. As shown below, their average adjusted loss over the three-year period was £4.6 million, giving them headroom of £25.3 million against the allowable limit.

Losses are standard in the Championship. In 2023/24, only four clubs made a profit, and all of them did so thanks to player sales. Using those 2023/24 figures as a benchmark, Derby’s loss would have ranked tenth-best in the division, with fourteen clubs recording heavier deficits.

Net Assets

Net assets or liabilities represent the difference between total assets and total liabilities and correspond to the club’s net equity.

In 2024/25, Derby reported net liabilities of £44.9 million, a deterioration from £33.6 million the previous year. While this technically means the club lacks sufficient assets to cover its debts, the deficit is largely driven by the £63 million owed to its parent company, Clowes Development (UK) Ltd. The club has indicated that part of this balance is expected to be converted into equity.

Total assets stood at £40 million, including £22 million for the stadium and other facilities, £10 million in player assets, £5 million in transfer fees receivable, plus cash and other short-term assets.

Total liabilities amounted to £85 million, consisting of £63 million owed to Clowes, £6 million in transfer fees payable, and various other short-term liabilities and provisions.

Derby are not alone in reporting net liabilities. Using the latest available figures (2024/25 for Norwich and Derby, and 2023/24 for all other clubs), only 11 of the 24 Championship teams recorded a positive net asset position.

Player Trading

The 2024/25 season marked the first time Derby made any significant investment in the squad, spending £12 million on new signings, with Norway’s Sondre Langås and Sweden’s Jacob Widell Zetterström the headline arrivals.

They recovered almost the same amount, generating £11 million in transfer income, largely through the sale of Eiran Cashin to Brighton.

Derby’s £12 million outlay was likely around the divisional average. However, once player-sale income is taken into account, the club’s net spend was essentially neutral.

The club has continued its investment this season, bringing in American Patrick Agyemang and Scotland’s Max Johnston for a combined estimated fee of £10 million.

Football Net Debt

Football net debt represents the total amount a club owes to external parties. It includes bank loans (net of cash holdings), funding from owners, loans from related entities such as a parent company, and outstanding transfer fees payable to other clubs, minus any transfer fees the club is due to receive.

Since the acquisition, Derby’s debt has grown, reaching £63.1 million by the end of 2024/25. This loan, provided by Clowes, is unsecured and interest-free, with part of it expected to be converted into equity. The club held no third-party loans at the end of the season.

Additionally, Derby carries a net liability of £1 million for transfer fees payable.

Debt across the Championship totaled £1.4 billion in the 2023/24 season, averaging £58 million per club. More than £1.1 billion of this comprises loans from owners or owner-related companies, which, as is likely the case with Derby, are often later converted into equity. Outside of a sale process, repayments of such owner loans are rare.

Based on the most recent published figures, Derby’s debt ranks eighth among Championship clubs.

Cash Flow

Cash Flows are reported in three categories:

Cash Flows from Operations refer to cash generated from the club’s core activities—revenue minus day-to-day costs such as salaries, rent, and utilities.

Cash Flows from Investments include cash spent on player acquisitions and facility improvements, net of player or asset sales.

Cash Flows from Financing cover new loans or equity raised, less repayments or buybacks. If operational cash flow cannot fund investments, the shortfall is usually met through financing.

Like most Championship clubs, Derby has consistently reported negative operating cash flows. Over the past three years, the club has had to raise £64 million, including £20 million as part of the acquisition, with the remainder used to fund operating losses.

The 2024/25 season followed a similar pattern. Operating costs—including staff and day-to-day expenses—totalled 159% of revenue, resulting in negative operating cash flow of £17 million.

Net cash flow from investments was £1 million, with £6.1 million spent on player acquisitions and £1.7 million on other assets, offset by £9.1 million received from player

sales. This left a substantial shortfall, which was covered by a further £16.2 million loan from Clowes.

Comments