Crystal Palace Financial Results 2023/24

- Matchday Finance

- Apr 30, 2025

- 11 min read

Updated: Jul 4, 2025

Season 2023/24 was Crystal Palace's 11th consecutive season in the premier league, finishing 10th, matching their highest-ever position in the top-flight.

Palace's run in the premier is remarkable for its consistency. Since their promotion, their highest finish is 10th and the lowest finish is 15th, a span of only 6 places over 11 seasons. If you are looking for a model of stability, then Palace is your club.

Late in the 2023/24 season, there was a chance that Crystal Palace’s remarkable consistency might come to an end. Sitting in 14th place with a tough run-in ahead, the outlook was uncertain. But an astonishing finish—six wins from their final seven matches, including victories over Liverpool, Newcastle, Manchester United, and Aston Villa—lifted them to a 10th-place finish, equaling their best-ever result in the Premier League. Their cup campaigns, however, brought no such joy, with early exits in the third round of both the FA Cup and Carabao Cup.

This season began poorly, but Palace soon returned to familiar territory, sitting in 12th place at the time of this report. The standout moment so far has been a dominant 3–0 win over Aston Villa that booked their place in the FA Cup final—a chance to claim their first-ever top-flight trophy.

Palace's financial approach follows a similar pattern to their on-field performance. The club maintains a mid-level of investment, avoiding the spending excesses seen at several other clubs. Remarkably, in the three seasons to 2023/24, did not sell a single player of note, a very uncommon feat that speaks to strong squad retention and careful financial management. This approach has however shifted slightly this season with the departures of Oilse, Anderson and Johnston.

Part of Palace's measured financial stance may be due to the club's ownership structure. No single figure holds a majority stake. John Textor, with the largest share at 45%, has expressed interest in gaining control but has not been able to achieve this.

Overview of Crystal Palace's Financial Results 2023/24

While Crystal Palace have taken a more conservative financial approach compared to some Premier League clubs, they have still been operating at a loss in recent seasons. The club recorded losses of £28 million and £30 million in the two seasons prior to 2023/24, with the season 2023/24 following a similar trend, posting a £36 million loss.

However, these figures remain within the boundaries of the Premier League’s Profit and Sustainability Rules, meaning Palace face no compliance concerns.

The club’s 10th-place finish in 2023/24 brought a slight revenue boost, with total income rising by £10 million to £190 million. However, this gain was offset by increases in amortisation and interest expenses, contributing to the larger overall loss.

To support operations, the club has raised significant additional funding—£156 million over the three seasons up to 2023/24, with a further £37.5 million raised this season.

Turnover:

Turnover rose by £10 million to £190 million, the eleventh highest in the league and a record for Palace.

Matchday revenue increased by 1.5 million to £13.8 million, with one extra cup match.

The higher league finish lifted broadcast revenue 4 million to 145 million.

Commercial and player loan income rose by £4 million to £31 million.

Staff Costs:

Staff costs before player sales rose 9 million to 180 million one of the lowest in the league, Only Brentford and the three relegated clubs have lower staff costs.

Staff costs before player sales account for 94% of revenue, the 10th highest in the league.

Player sales generated only £1 million in profits with no major departures for the third consecutive season.

Profitability:

The club reported a pre-tax loss of £36 million, higher than the £30 million loss from the previous season.

Player Trading:

Palace continued to invest in the squad, spending £90 million on new signings, including Wharton, Franca, Munoz and Henderson.

Football Debt:

Palace have total outstanding loans of 92 million, including 12 million from shareholders and related parties.

Transfer related debt increased to £65 million up from £42 million the prior year.

Cash Flow:

Operating cash flow remained strong, reaching £37 million in 2023/24—the highest among clubs outside the 'Big Six' and up from £17 million the previous season.

Palace raised £39 million through a share issue, bringing total equity funding to over £156 million across the last three seasons.

With five additional cup matches this season, Crystal Palace are set to see further growth in matchday revenue. They remain however the only Premier League club not to raise ticket prices this season. Broadcast revenue will continue to hinge on their final league position, and with just four points separating them from eighth place, there’s still potential to improve on last season’s 10th-place finish. Commercial income remains harder to forecast, though a new front-of-shirt sponsorship deal with Vietnamese online gambling company Net88—reportedly worth £10 million per year—will provides a boost.

Palace will receive a significant financial windfall from player sales. The departures of Olise, Andersen, Johnstone, and Ayew mark their first major outgoing transfers in four seasons, bringing in around £65 million in profit. As a result, the club is on course to post a solid profit this season.

On the pitch, hopes remain high for a historic first qualification for European competition. An FA Cup victory would secure a Europa League spot, while an eighth-place league finish would likely earn a place in the Europa Conference League.

Next Read

For a full breakdown of the Premier League’s 2023/24 financial results, check out our recent blog: Premier League Financial Results Season 2023/24

Crystal Palace Turnover 2023/24

Like many of the mid-size clubs in the Premier League, Fulham' turnover is heavily reliant on their league position and the corresponding distributions from the Premier League. In the 2023/24 season £140 million came from this source, accounting for 73% of their total income. Their matchday revenue, at £14 million, ranks 15th in the league, while their commercial revenue of £31 million is roughly 10% of what the top clubs generate.

Overall, Palace's total revenue of £190 million places them equal with Notts Forest at 11th in the league.

While broadcast revenue will fluctuate based on their league position, Crystal Palace has successfully increased matchday and commercial revenue in recent seasons.

Matchday Revenue

Matchday revenue is influenced by factors such as the number of home games, average attendance, ticket prices, and the club's ability to generate income from hospitality events and corporate boxes. The only exception to this is domestic cup matches, where revenue is shared between the clubs and the FA.

One extra cup game and slightly higher league league attendances lifted Matchday revenue by 1.4 million to 14,5 million. Palace have continued to buck the trend in terms of ticket price increase, with no increases for season 2023/24 (or this season). This meant their average revenue generated per fan stayed the same. At 25.60 it is comparable to Aston Villa and Bournemouth and is the lowest in London by some margin.

Selhurst Park, the home of Crystal palace, has a capacity of 25.456, one of the lower capacities in the league. Like many clubs there has been talk of developing the ground and Palace now have firm plans to develop their main stand. The club stated in December last year,

"Following a summer of preliminary works, the Main Stand development is progressing well and is currently in its final planning phase, including ongoing negotiations with contractors, with the intention of starting building works at the conclusion of the 2024/25 football season"

This is exciting news for the club which will increase the capacity to 34,000 and significant enhance is corporate hospitality and retail offerings. Like most clubs, they are looking for way to reduce their reliance on broadcast revenue.

This season, matchday revenue should increase by 10 to 15% as their great cup run has meant five extra matches of paying fans (where Palace receive 45% of the revenue).

Broadcast Revenue

Broadcast revenue primarily comes from central distributions from the Premier League, UEFA (if the club participates in European competitions), and revenue generated through the club's media platform. For Crystal Palace, broadcast revenue is almost entirely derived from Premier League distributions.

The chart below illustrates the distribution by club for the 2023/24 season. A significant portion, 67%, is evenly distributed among all clubs, with the remainder based on league position and the number of televised live games. For more information on how the Premier League central payment distribution system works check out our blog Premier League Broadcast Distribution for Season 2023/24.

Palace earned £95.1 million from the equal share, £31 million for finishing in 10th place, and £13.5 million from their 15 live televised games.

Palace's broadcast income will depend on their final league position however it is looking like they will finish in a similar spot to last season-no surprises there! It is worth noting that the Premier League is in the final year of its current three-year broadcast cycle, so no overall increase in domestic revenue is expected. However, a significant uplift is on the horizon for 2025/26, with international broadcast rights set to rise by 25%. See recent blog on the new deals.

Commercial Revenue

Crystal Palace’s commercial revenue—which includes sponsorships, retail, tours, and other business activities—rose to £31 million this season, up from £27 million the previous year.

Palace are one of eight clubs that disclose their sponsorship revenue. The chart below shows the gap between the big 6 and rest, with Palace's sponsorship revenue only 10% of Manchester United's. Front-of-shirt sponsorship is a particularly lucreative area for the bigger clubs, generating around 60 million per year, whereas the mid-size clubs may earn 10 million or less.

Crystal Palace's shirt sponsor was Cinch for the 2023/24 seasons but like many clubs they have now partnered with the betting industry, securing a sponsorship deal for the 2024/25 season with Vietnamese betting company Net88 for a reported 10 million per year. However, this agreement can only last for two years, as Premier League clubs will be banned from displaying betting company logos and names on the front of shirts starting in the 2026/27 season.

Palace's total commercial revenue of 31 million is the thirteenth highest in the league.

Season 2023/24 Staff Costs

Crystal Palace have managed staff costs effectively, with combined salaries, wages, and player amortisation totaling £180 million—just £4 million more than five seasons ago. This stability likely reflects the consistent squad and a lack of major big-money signings. Given that the league average for cost increases over the same period is around 25%, this highlights Palace's strong financial discipline.

Crystal Palace’s staff costs before player sales ranked 16th in the Premier League, with only Brentford and the three relegated clubs spending less.

Given that Palace finished 10th, this suggests the squad offered excellent value for money. In fact, they recorded the largest positive gap between staff cost ranking and league position of any club.

Staff costs before player sales were equivalent to 94% of turnover—a key indicator of financial sustainability. While this figure may seem high, it’s actually one of the lower ratios outside the traditional 'big six', with seven clubs exceeding 100%, suggesting they may need to sell players to avoid significant losses.

Profit on Player Sales

As noted earlier, Crystal Palace were the only Premier League club not to register any significant player sales over the three seasons leading up to 2023/24—a notable achievement, especially given the sharp rise in transfer market activity. League-wide, profits from player sales surged by over 60% last season, reaching £1.1 billion, with several clubs forced to sell key players to remain compliant with Profit and Sustainability Rules.

However, this has shifted for Palace in the current season, with the departures of Olise, Andersen, and Johnstone expected to generate approximately £65 million in profit for the club.

Season 2023/24 Profit and Loss

While Crystal Palace take a relatively cautious approach to financial management and steer well clear of breaching Profit and Sustainability Rules (PSR), they are still operating at a loss. Over the past three seasons, the club has recorded losses exceeding £90 million—which doesn't sound too conservative.

However, looking at operating profit—which excludes exceptional items such as player or asset sales (of which Palace have had none)—a clearer picture emerges. By this measure, Palace rank fourth-best in the Premier League over the last three seasons.

All clubs report operating losses to some degree, but this comparison highlights which clubs are dependent on selling players—or, in Chelsea’s case, other assets—to remain within PSR limits.

Looking at the profit and loss summary below, it's clear how consistent Crystal Palace’s financial performance has been from season to season—something that sets them apart from most other Premier League clubs.

In season 2023/24 a £10 million rise in revenue was largely absorbed by a £4 million increase in salaries and wages and a £5 million rise in amortisation costs, leaving operating profit unchanged at £23 million.

The most notable cost movement was an £8 million increase in net interest payments. This is primarily due to the recognition of discounts on deferred payments for player registrations.

This season’s financial results will have one notable difference as the club has already generated around £65 million in profit from player sales. Assuming only modest increases in revenue and costs, Palace are on track to report a strong profit for 2024/25.

Additionally, if the team can capture their first top-flight trophy with an FA Cup victory, it would secure European qualification for next season—bringing with it a significant boost in revenue for season 2025/26.

Season 2023/24 Player Trading

In the 2023/24 season, Crystal Palace invested £90 million in new signings, including Lerma, França, Henderson, Holding, Muñoz, and Wharton. This brings their total spending on player acquisitions to £235 million over the past three seasons—placing them 14th in the Premier League.

However, when looking at net spend (total spend minus player sales), Palace rank significantly higher—eighth in the league—due to the lack of notable sales during this period.

This investment has continued into the current season, with approximately £90 million spent on new additions such as Nketiah, Lacroix, Sarr, Riad, and Esse. For the first time in four seasons, the club has also seen key departures, including Olise, Andersen, Johnstone, and Ayew, generating around £85 million in total.

Football Net Debt

At the end of season 2023/24 Crystal Palace had £92 million in outstanding loans, including £12 million owed to shareholders and related parties. In recent seasons, the club has largely relied on equity funding, which has kept overall debt levels stable.

In addition to this, Palace also have £66 million in transfer fees owed to other clubs.

Cash Flow

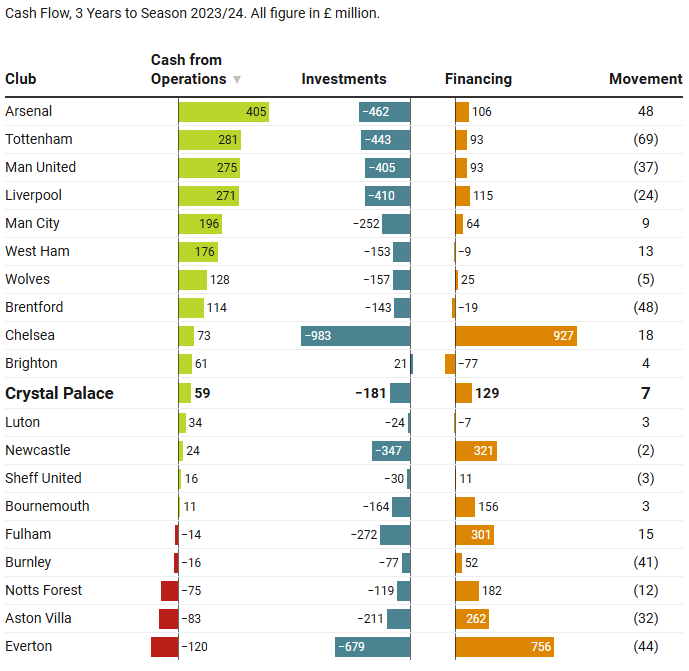

Like many clubs, Crystal Palace have relied on the financial backing of their owners. However, unlike some, they do generate cash from their day-to-day operations. While cash flows can fluctuate from year to year, over the past three seasons, Palace have generated £59 million from operations (before accounting for any investments or new funding).

During this period, they’ve invested £150 million in players and an additional £26 million in facilities. This resulted in a shortfall of £117 million, which was covered through share issues. Part of the funds raised was also used to reduce their debt.

As shown in the chart below, not all clubs generate positive cash flows, with five clubs reporting negative flows over the last three seasons. The data also highlights the extent of Chelsea’s squad investment and Everton’s significant spending on both operations and infrastructure development.

Financial Outlook

Back in November 24, Crystal Palace found themselves in 19th place with just one win from their first 12 games, staring down the barrel of a long relegation battle. Fast forward to April, and the turnaround has been remarkable: they now sit comfortably in 12th, have reached the FA Cup final, and have two potential routes into European competition. A remarkable transformation in just five months.

This resurgence carries significant financial benefits. More cup fixtures mean increased matchday revenue, a higher league finish brings greater Premier League distributions, and European qualification would provide a major boost across all revenue streams for the 2025/26 season. The outlook is bright for the Eagles.

Financially, Palace are backed by serious wealth, with three billionaires listed among their shareholders. That said, their investment strategy has been more cautious compared to clubs like Aston Villa, Fulham, Everton, Newcastle, and Brighton. While not spending at the same levels, they’ve made smart, efficient use of their resources. Majority owner John Textor had explored selling his stake—particularly during his interest in acquiring Everton—but has also suggested he may consider increasing his share, leaving the club’s ownership situation somewhat uncertain.

Regardless, Palace appear to be in good financial shape. They are making the most of their resources on the pitch, benefit from stable management, and boast a thriving academy—a vital component of long-term financial sustainability in modern football. Additionally, the planned construction of the new Main Stand marks a significant step forward for the club’s infrastructure and future revenue potential.

To access all the numbers and receive regular updates, sign up to the Matchday Finance platform.

Comments