Aston Villa Financial Results 2023/24

- Matchday Finance

- Apr 25, 2025

- 14 min read

Updated: Jul 4, 2025

Season 2023/24, their fifth consecutive in the premier league, was a historic season for Aston Villa as they qualified for the Champions League, returning to Europe's top competition for the first time in over 40 years.

Following a seventh-place finish in 2022/23, Villa spent most of the season in the top four. Despite some late-season nerves, they managed to hold off Tottenham to secure the fourth and final Champions League spot—a landmark moment for the club. They also enjoyed a strong run in the Europa Conference League (ECL), reaching the semi-finals, though their domestic cup campaigns were short-lived, exiting in the fourth round of the FA Cup and the third round of the Carabao Cup.

Villa’s recent rise is impressive when looking at their recent history. In 2016/17, the club had slumped to 13th in the Championship and appeared to be in steep decline. That changed with the arrival of new ownership—Egyptian billionaire Nassef Sawiris and American investor Wesley Edens—who acquired the club in 2018. Promotion followed in 2018/19 though the play-offs, and after a few seasons of mid-table stability, Villa have emerged as regular contenders for European qualification. Their Champions League campaign this season was particularly impressive, gaining automatic qualification from the league stage including a memorable victory over Bayern Munich only to just fall to PSG 4-5 on aggregate in the quarter finals.

However, this resurgence has come at a steep financial cost. Since taking over in 2018, Villa’s owners have invested approximately £700 million—averaging £100 million per year. Of that the vast majority—over £600 million—has been spent on player acquisitions and operating expenses. It’s a staggering figure that demonstrates the financial demands of competing at the top of English football.

Overview of Aston Villa's Financial Results Season 2023/24

As a club aiming to compete with the very best—but without the income levels of the Premier League’s 'big six'—striking the right balance between investment and compliance with the league’s Profit and Sustainability Rules (PSR) remains a significant challenge. In the 2022/23 season, the club reported losses of £120 million. Season 2023/24 isn’t much better, with losses totaling £86 million, despite a nearly £60 million increase in turnover and £64 million in player sale profits.

It’s worth noting that Villa extended their financial year-end to June, aligning with the majority of Premier League clubs. This adjustment also allowed the club additional time to finalize late player sales in 2023/24. When comparing figures to the previous season, it’s important to account for the fact that 2023/24 reflects a 13-month reporting period versus 12 months in 2022/23. While this doesn’t affect revenue comparisons—since no matches were played in June—it does impact cost figures.

Financial Highlights for the 2023/24 Season:

Turnover:

Villa’s turnover rose £58 million to £276 million, the eighth highest in the league.

Matchday revenue saw a 49% increase to £28 million, driven by seven ECL matches and ticket price increases.

Premier league broadcast distributions were up £14 million to £162 million due to the higher league finish.

Reaching the semi-final of the ECL earned them £14 million.

Commercial revenue was up £22 million to £63 million, with sponsorship up 6 million and other commercial revenue up £17 million.

Staff Costs:

Staff costs increased by £60 million for the 13 months, to £348 million, the seventh highest in the league.

Staff costs before player sales account 126% of revenue, which is the highest in the league.

Player sales generated £65 million in profits including Archer, Ramsey and late season sales of academy players Kellyman and Iroegbunam in 'player swaps'.

Profitability:

The club reported a pre-tax loss of £85 million, a slight improvement from the £120 million loss recorded in the previous season.

Player Trading:

Villa continued to invest in the squad, spending £168 million on acquisitions, including Torrens, Diab, Maatsen and Dobbin.

Net transfer spending was £85 million (up from £11 million the prior year) after £83 million was received for player sales.

Football Debt:

Villa's only conventional debt is a £20 million overdraft.

They are a net lender to group companies, with £50 million owed to them.

Net transfer debt dropped to £84 million from £110 million the prior year.

Cash Flow:

Villa has consistently negative operating cash flows, -£48 million in 2023/24 down from -£23 million the previous year.

£148 million was raised through a share issue, taking the total to over £600 million since the club was acquired.

Profit and Sustainability

Earlier this year the Premier League announced that no club has breached the Profit and Sustainability Rules, however Villa, with the two seasons of heavy losses, is one club that would have been close to the limit

At face value, Aston Villa have posted losses totaling £206 million over the past three seasons. Note, that 2021/22 was break-even thanks to the sale of Jack Grealish. Under PSR, clubs are limited to a maximum loss of £105 million over a three-year period—but with spending on the women’s team, youth development, community work, and depreciation on facilities excluded.

Villa are one of the few clubs to provide detailed disclosures on these costs. Over the three seasons up to and including 2023/24, Villa reported approximately £90 million spent on youth development, the women's team, community programs, and tangible asset depreciation. In addition, it’s fair to assume that costs related to the '13th month' would be excluded, likely around 25 million. This brings total add-backs to around £115 million—enough to bring them under the PSR threshold.

Looking ahead, the 2021/22 break-even season will fall out of the rolling three-year PSR window, which will put pressure on the current year's finances. Adjusted losses from the past two seasons already stand at around £120 million, meaning Villa will need to post only a modest loss this season (pre-PSR adjustments) to remain compliant.

Their return to the Champions League will help significantly, with revenue expected to jump to around £350-370 million—up from £276 million—thanks to UEFA prize money and better commercial opportunities. Costs may reach around £440 million, however, £65 million has already been banked from player sales, which helps narrow the gap. Still, it’s likely Villa will once again be close to the PSR limit, and a few minor sales at the end of the season may be necessary to ensure compliance.

This season, Villa are again challenging for another Champions League spot and are in the FA Cup semi-final, the first time for 15 years. The ongoing risk, though, is that their cost base has grown to a level where Champions League qualification becomes essential to maintaining financial stability. Without it, player sales may be unavoidable, and momentum can quickly unravel. There's still a notable revenue gap between Villa (and fellow challengers Newcastle) and the traditional 'Big Six'. For Villa in particular, the lack of top-tier facilities poses a further barrier to closing this gap quickly.

Over £600 million in investor funding has been required to get the club to this point. The coming seasons will be crucial in determining whether Villa can transition from 'challenger' to consistent, sustainable contender at the top of English and European football.

Next Read

For a full breakdown of the Premier League’s 2023/24 financial results, check out our recent blog: Premier League Financial Results Season 2023/24

Aston Villa Seasons 2023/24 Turnover

With Aston Villa making a return to European competition through the Europa Conference League and securing a fourth-place finish in the Premier League, it's no surprise that the 2023/24 season brought in record-breaking revenue. The club reported a turnover of £276 million—an increase of £58 million from the previous year—ranking them 17th in Europe and eighth in the Premier League.

As expected, all major revenue streams saw growth last season, fueled by UEFA payouts, eight additional home fixtures, and new sponsorship agreements.

Matchday Revenue

Matchday revenue is influenced by factors such as the number of home games, average attendance, ticket prices, and the club's ability to generate income from hospitality events and corporate boxes. The only exception to this is domestic cup matches, where revenue is shared between the clubs and the FA.

Villa Park, Aston Villa’s home for the past 128 years, holds 42,918 fans and, like all Premier League grounds, sells out every match. This season saw a significant 30% rise in paying attendance, driven by the club’s Europa Conference League run, which added seven extra home games. Ticket prices also saw a noticeable increase, with average matchday revenue per fan rising from £22.10 to £25.10—a 14% boost. Despite the increase, this figure remains one of the lowest in the league, with only five clubs generating less per fan. While price hikes are rarely welcomed by supporters, Villa could be seen as offering some of the best value for money in the league.

In recent years, Aston Villa have unveiled various plans for stadium development, including a proposed new North Stand that would raise Villa Park’s capacity to 50,000. However, these plans were put on hold by Chris Heck, the club’s new President of Business Operations. The current strategy focuses on smaller-scale upgrades—such as introducing a new fanzone, enhancing accessibility, and expanding hospitality offerings.

There are no intentions to leave Villa Park, but modernizing the historic ground remains a challenge. In the context of today’s Premier League, a 42,000-seat stadium falls short compared to the capacities of the league’s top clubs.

This coming season, Villa will host a similar number of home fixtures as last year, but revenue growth is projected to come from further ticket price increases and the financial boost of staging high-value Champions League matches, particularly through hospitality and other premium matchday experiences.

Broadcast Revenue

Broadcast revenue primarily comes from central distributions by the Premier League, distributions by UEFA (if the club participates in European competitions, as Villa did), and revenue generated through the club's media platform.

67% of Premier League Broadcast Distribution for Season 2023/24 are shared equally among all clubs, with the remainder allocated based on league position (merit payments) and the number of televised live games (facility fees). Each league position adds an additional £2.8 million, and each live game generates around £900k.

With Aston Villa climbing four places in the league standings, their merit payments saw a boost, while an additional four live broadcast games led to higher facility fees. Altogether, the club received £162.4 million in Premier League distributions—an increase from £148.2 million the previous season.

UEFA distributions also follow a central revenue-sharing model. For each competition, clubs receive a participation fee, prize money for group stage results, and additional payments for advancing through the knockout rounds. There’s also a share based on a club’s UEFA coefficient, which reflects European performance over the past five seasons, along with a TV market pool allocation, influenced by the size of the club’s domestic market.

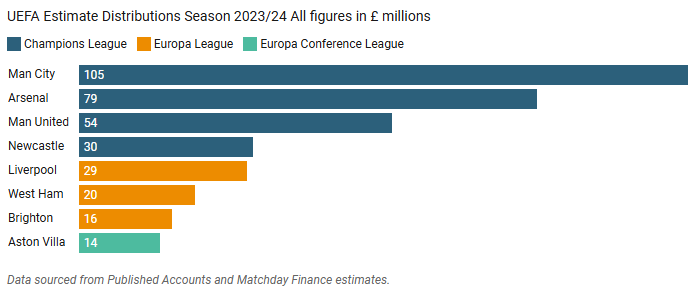

Naturally, the payouts vary widely between the Champions League, Europa League, and Europa Conference League. Since Villa competed in the third-tier Europa Conference League, their total distribution was £14 million—the lowest among English clubs, despite reaching the semi-finals.

This season, Aston Villa are set to receive a major financial boost from their Champions League campaign, with earnings estimated at around £70 million—substantially higher than the £14 million they received from the Europa Conference League this year. Their Premier League distributions will largely depend on their final league position, which is currently tracking close to last season’s.

It’s worth noting that the Premier League is in the final year of its current three-year broadcast cycle, so no overall increase in domestic revenue is expected this season. However, a significant uplift is on the horizon for 2025/26, with international broadcast rights set to rise by 25%. See recent blog on the new deals.

Commercial Revenue

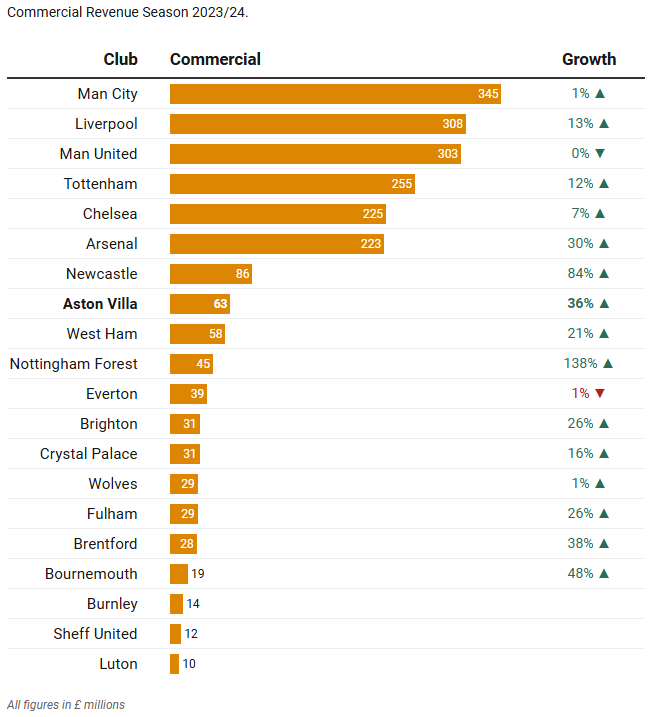

Aston Villa’s commercial revenue—which includes sponsorships, retail, tours, and other business activities—rose to £63 million this season, up from £46 million the previous year.

The club separately reports sponsorship income, which increased from £16 million to £21 million. Villa is one of eight Premier League clubs that disclose sponsorship figures individually. Among clubs outside the traditional 'Big Six', Villa leads the pack; however, their sponsorship revenue is still only around 15% of Tottenham’s, underscoring the significant financial gap that remains.

That gap could begin to narrow following Villa’s recent success, with commercial income expected to grow further this year. They have signed betting company Betno as front-of-shirt sponsor, with the deal reportedly worth £20 million per season. However, this agreement will be short-lived, as betting sponsors will no longer be allowed on shirts after the 2025/26 season.

Overall, Villa’s total commercial revenue ranks eighth in the Premier League, trailing Newcastle and still some distance behind the Big Six.

Season 2023/24 Staff Costs

Aston Villa have made substantial investments in their staff, now ranking sixth in the Premier League for wages—surpassing even Tottenham. However, it’s important to consider that Spurs were not involved in European competition last season, and Villa’s reported figure covers a 13-month period, meaning they could slip back to seventh in the upcoming season.

Villa’s wage growth has also significantly outpaced other challenger clubs, especially over the past two seasons. Last year, their wage bill reached £252 million—£38 million more than Newcastle’s—though again, Villa’s final figure reflects an extended reporting period.

Amortization—the write-down of player transfer fees—has continued to rise, increasing by £4 million to £96 million, reflecting the £400 million Aston Villa have invested in their squad over the past three seasons.

Total staff costs before player sales now stand at £348 million, the seventh highest in the Premier League. While Villa have overtaken Spurs in wages, Tottenham still edge ahead overall due to their relatively high amortization expenses.

Villa’s staff costs before player sales are significantly higher than their revenue, with a ratio of 126% in the 2023/24 season—the highest in the league. Adjusting for the extra month brings this down to 117%, still a high figure and the fifth highest in the Premier League. At such elevated ratios, clubs are at risk of substantial losses unless they generate income through player sales (or asset sales, as seen with Chelsea).

Villa may have already exceeded UEFA’s current squad cost ratio, which is set at 80% (and will drop to 70% next season). This ratio compares player salaries and wages to revenue plus profit from player sales. The penalties for breaching this limit are typically fines, which, so far, have not been excessive relative to the financial resources of the clubs involved.

Profit on Player Sales

As mentioned, Villa relied on profitable player sales to remain compliant with UEFA's Profitability and Sustainability Regulations (PSR). Towards the end of the season, just before the close of their financial period, the club engaged in several 'player swap' deals. These included Kellyman from Chelsea (Maatsen to Villa), Iroegbunam to Everton (Dobbin to Villa), and Luiz to Juventus (Illing-Junior and Barrenechea to Villa).

These types of deals allow both clubs to report a profit on the transfer while the cost of the acquisition is amortized over the player’s contract, effectively delaying the financial impact. However, there are concerns that such deals can result in inflated transfer fees, benefiting both clubs in the short term.

Together, these player swap deals, along with the sales of Ramsey and Archer, generated a £65 million profit.

Villa is not alone in relying on player sales to stay within PSR guidelines. As seen in the chart below, the total profit from player sales in 2023/24 saw a 62% increase compared to the previous season, which itself was a record,

Villa also saw two major departures this season, with Duran and Diaby moving to the Saudi Pro League, which is expected to bring the club around £50 million in profit.

Season 2023/24 Profit and Loss

Since the acquisition in 2018 Villa have consistently made losses, with only one break-even year, which was when they sold Jack Greelish to Manchester City for £90 million, which was all profit.

In the 2023/24 season, turnover reached £276 million, a £58 million increase from the previous year. Salaries and wages increased by £58 million, and general operating expenses (the day-to-day costs of running the club) increased by £5 million. This resulted in an EBITDA (Earnings Before Tax, Depreciation, and Amortization) of -£43 million, the same as the previous season’. A negative EBITDA signals that there is no available cash for investment without securing additional funding.

Amortization (the write-down of player acquisition costs) increased slightly to £97 million resulting in an operating loss, (the result before player sales and exception items), of £145 million. Whilst only two clubs (Luton and Sheffield United) reported an operating profit in season 2023/24, Villa's result is still one of the worst in recent seasons, with only Chelsea reporting bigger operating losses.

Profit from player sales of £65 million reduced these losses, to arrive at the £86 million loss for the season, better than the £120 million loss the previous season.

Villa £86 million loss is the second highest loss, with only Manchester United's huge £131 million worse.

As mentioned, participation in the Champions League with grow revenue this season to around £350-370 million Costs may reach around £440 million, offset be £65 million banked from player sales. Still, Villa is still likely to report a loss, unless they again engage in further end-of-season player sales or 'swaps'.

Season 2023/24 Player Trading

Since returning to the Premier League in the 2019/20 season, Aston Villa have spent £692 million on strengthening their squad. Notable signings include Ollie Watkins, Emiliano Buendía, Leon Bailey, Lucas Digne, Diego Carlos, Moussa Diaby, Pau Torres, Amadou Onana, and Ian Maatsen. In recent seasons, the club has also generated around £250 million through player sales, with high-profile departures such as Douglas Luiz, Jack Grealish, and Cameron Archer (who was sold twice). This results in a net transfer spend of £442 million since their top-flight return.

Over the past five years, Aston Villa's total transfer spend ranks as the sixth highest in the Premier League, with their £442 million net spend also placing them sixth in the league.

As previously mentioned, Aston Villa needed to generate profits through player sales at the end of the 2023/24 season to comply with PSR. Three key players were involved in swap deals: Kellyman joined Chelsea, Iroegbunam moved to Everton, and Douglas Luiz was transferred to Juventus. The main signings in season 2023/24 included Moussa Diaby—who has since departed for the Saudi Pro League—Pau Torres, and Morgan Rogers, whose £8 million transfer has proven to be an excellent piece of business.

In the current season, Villa have continued their squad investment with the arrivals of Amadou Onana and Donyell Malen, while both Diaby and Jhon Durán have moved to the Saudi League. The club also engaged in some interesting trading: Cameron Archer, sold to Sheffield United in 2023/24 with a buy-back clause activated upon their relegation, was re-signed and promptly sold to Southampton. Similarly, Jaden Philogene, sold last season, was bought back by Villa this year before being sold on to Ipswich Town.

Football Debt

Aston Villa's only external debt consists of a £20 million overdraft and £13 million owed to their parent company. To date, the club has primarily been funded through equity, meaning they've relied very little on debt financing.

In addition, Villa have £164 million in outstanding transfer fee payments to other clubs. However, this is partially offset by £80 million in transfer fees receivable from player sales.

Cash Flow

Aston Villa have clearly relied on the financial backing of owners Nassef Sawiris and Wes Edens. Since taking over the club in 2018, their ownership group had invested £600 million by the end of the 2023/24 season, with an additional £90 million injected this season.

When compared to other principal club owners, their total investment ranks just behind Everton and Fulham—both of whom have also made significant commitments to infrastructure and facility development.

Aston Villa have been operating with negative operating cash flows—meaning the cash generated from their core business activities hasn’t been sufficient to cover their operating expenses. To cover this gap, a portion of the owners’ investment has been used to support day-to-day operations, while the rest has primarily gone toward player acquisitions.

As illustrated below, Villa are one of just five Premier League clubs to report negative operating cash flows over the past three seasons. The data also underscores the scale of Chelsea’s investment in their squad and Everton’s significant spending on both operations and infrastructure development.

Financial Outlook

There’s no questioning Aston Villa’s ambition—since the takeover in 2018, the owners have invested an average of £100 million per year. However, the challenge now lies in building a sustainable business model that complies with Premier League and UEFA financial regulations, while still competing consistently at the top level.

Villa’s cost base has risen to the point where qualifying for the Champions League is becoming almost essential. Without it, the club may be forced to sell key players to stay within financial limits. While there is room to grow revenue beyond the central distributions from the Premier League and UEFA, doing so is far from straightforward. Villa Park, with a capacity just over 40,000, presents a limitation—and any major expansion would take years to deliver. Unlike the biggest clubs, Villa can’t yet command premium ticket or commercial revenue, with average revenue per fan around a quarter of what Manchester United, Arsenal, and Chelsea generate. Commercial income is closely tied to brand strength, and although a Champions League presence will give that a boost, Villa’s commercial revenue still stands at only about 25% of Arsenal’s—who themselves have the lowest among the traditional "Big Six."

The club—and many observers—argue that the current and proposed financial rules from the Premier League and UEFA serve to protect the established elite, making it more difficult for ambitious clubs like Villa and Newcastle to break into that group, even with committed investment.

How this all unfolds over the next few years will be fascinating. What’s clear is that the foundations of a successful Premier League club remain unchanged: strong leadership (which Villa have), smart recruitment (which they’ve shown signs of), and a thriving academy system (another area where Villa excel).

Comments