Coventry City Financial Results 2023/24

- Matchday Finance

- Aug 16, 2025

- 9 min read

Coventry City missed out on promotion in the 2024/25 season after losing in the Championship play-offs for the second time in three seasons, finishing fifth thanks to a strong second half of the campaign.

It has now been 25 years since the club last competed in the top flight. In that time, Coventry have faced significant challenges on and off the pitch. They left their historic Highfield Road home in 2005 for the part council-owned Ricoh Arena, hoping to benefit from modern facilities. However, financial struggles soon followed.

The club narrowly escaped administration in 2007 thanks to a last-minute rescue from London hedge fund SISU Capital. Six years later, a dispute with the stadium’s owners pushed Coventry into administration, costing them 10 points and forcing a temporary move to Northampton. In a surprising twist, SISU then bought the club again. What followed was a slide to the fourth tier in 2017/18 and another exile from Coventry — this time playing home games at Birmingham’s St Andrew’s. It was a miserable time for the club and its supporters.

Since then, stability has gradually returned. Ownership changed in 2023, with local businessman Doug King taking control. A new agreement was struck with new stadium owners Frasers Group and the leadership of manager Mark Robins brought two promotions, a Championship play-off final, and an FA Cup semi-final.

After a poor start to the 2024/25 season, Robins was replaced by Frank Lampard, who guided the club to the play-offs once again, only to lose to Sunderland in the semi-finals.

This report examines what Coventry’s recent history means for their financial position by reviewing the club’s 2023/24 accounts — a season that saw them finish ninth in the Championship and produce a memorable FA Cup run, losing only on penalties to Manchester United in the semi-final. It was also the first full seasons results under the new ownership of King, through his wholly owned company CovCityCo Ltd.

Overview of Coventry City's Financial Results Season 2023/24

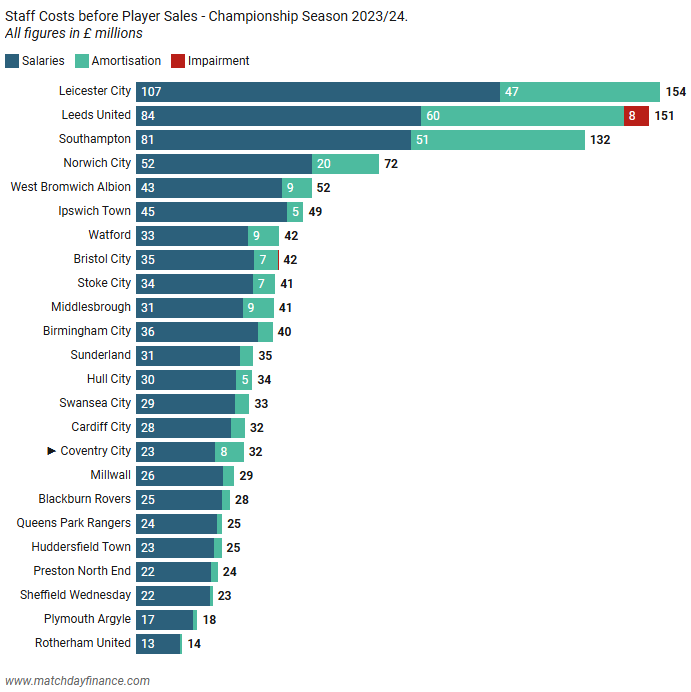

Coventry’s financial position has shifted dramatically in recent seasons, with turnover rising from £6 million in 2018/19 to £29 million in 2023/24, driven by growth across all revenue streams. This places the club around the Championship’s mid-table for total revenue. Staff costs have followed a similar trajectory, climbing from £6 million to £32 million over the same period — a steep rise, yet still only the 16th highest in the division and less than a quarter of champions Leicester City’s wage bill.

With total operating expenses of £35 million exceeding revenue, Coventry recorded a negative EBITDA of £5.8 million. However, the combined £24 million profit from the sales of Viktor Gyökeres to Sporting and Gus Hamer to Sheffield United enabled the club to post a rare pre-tax profit of £8.6 million — its first profit of note since administration and one of only four Championship sides to finish in the black.

The club has also demonstrated clear ambition in the transfer market, investing £35 million in player acquisitions — their first significant outlay in years — followed by a further £20 million ahead of the 2024/25 season.

Financial Highlights for the 2023/24 Season:

Turnover

Revenue increased by 44% to £29.3 million, the twelfth highest in the Championship.

Broadcasting income totalled £10 million, in line with clubs not receiving Premier League parachute payments.

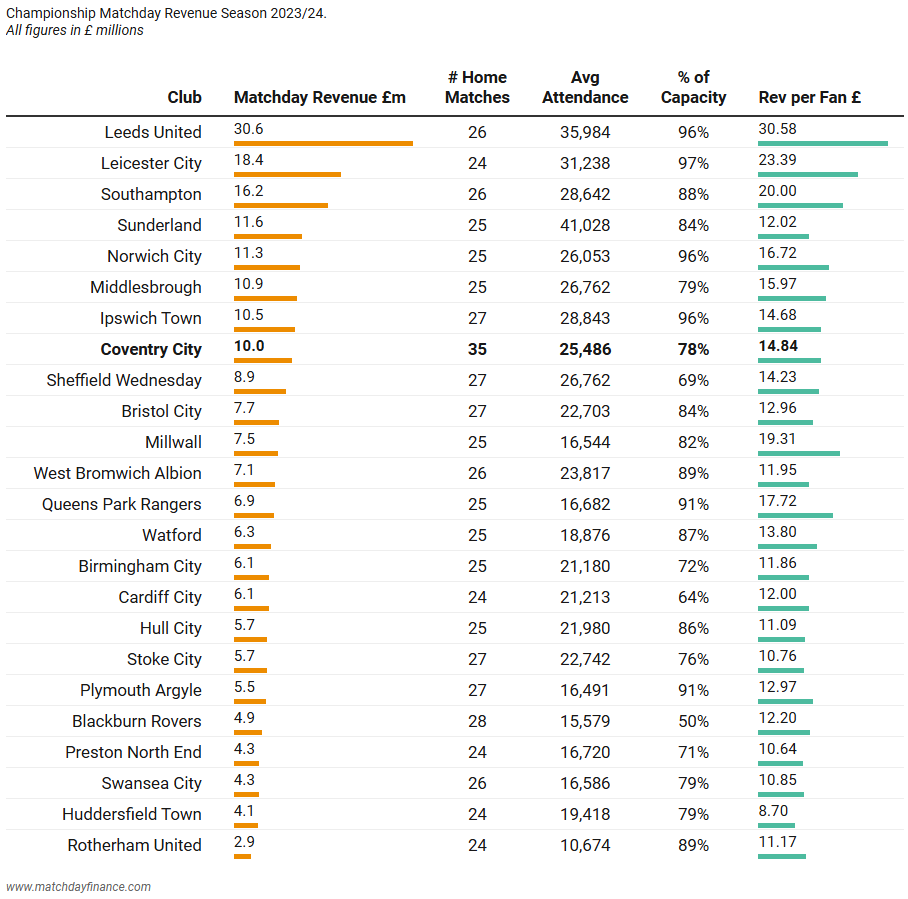

Matchday revenue rose by £2.8 million to £10 million, driven by a 27% increase in average attendance and nine additional cup matches, ranking eighth in the league.

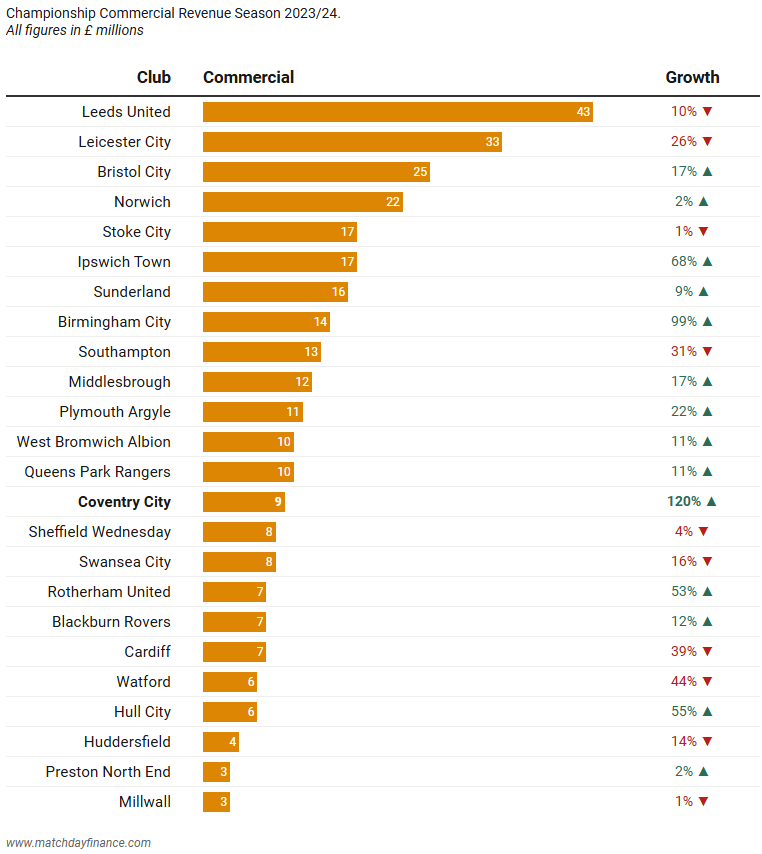

Commercial income more than doubled to £9.2 million, reflecting the FA Cup run and bringing retail operations in-house.

Staff Costs

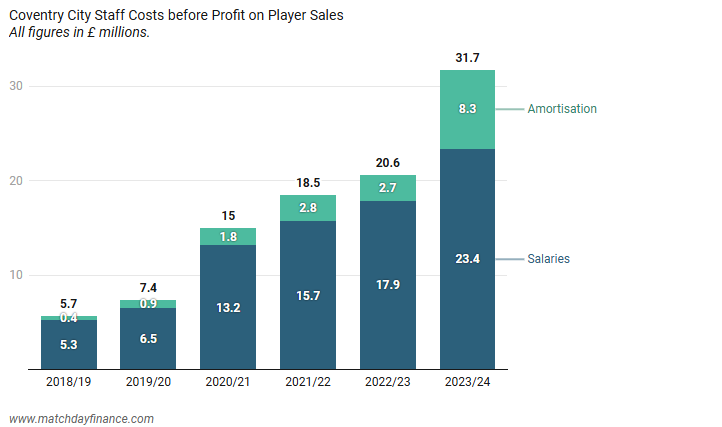

Wage bill increased 30% to £23 million following new signings and likely cup bonuses, still only the sixteenth highest in the division.

Amortisation charges jumped from £2.7 million to £8.3 million after £35 million was spent on player recruitment.

Combined staff costs, including amortisation, reached £32 million—less than a quarter of Leicester, Southampton, and Leeds, all benefiting from parachute payments.

Player trading generated £23.6 million in profit, primarily from the sales of Viktor Gyökeres and Gus Hamer.

Profitability

Pre-tax profit of £8.6 million, making Coventry one of only four Championship clubs to report a profit.

Player Trading

£35 million spent on new signings, including Wright, Simms, Mason-Clark, Kitching, van Ewijk, Torp, Thomas, and Sakamoto, each costing over £2 million—Coventry’s first notable spend in many years.

Player sales generated £24.6 million, mainly from the sales of Gyökeres and Hamer.

Football Debt

The club has a £30 million interest-free loan from parent company CovCityCo Limited.

£12.6 million is owed to other clubs for past signings.

£16 million is due from transfer instalments, likely relating to Gyökeres and Hamer.

Cash Flow

Whilst Coventry do not publish a Cash Flow statement, estimated operating cash flow before investment and financing was negative £1 million.

An estimated £21 million was spent on player acquisitions and £6 million invested in facilities, mainly the training ground.

An estimated £7 million was received for player sales.

To cover the funding gap, the club increased loans by £24 million.

Financial Outlook

Coventry’s finances have clearly improved under their new owner, and their return to the play-offs in 2024/25 marked further progress on the pitch. Revenues for season 2024/25 are expected to be similar to 2023/24, with higher attendances offset by fewer matches. Following a further £20 million investment in the squad, costs are set to rise, and with no significant player sales, the club is likely to post a pre-tax loss in the region of £15–20 million.

Next Read

For a full breakdown of the EFL Championship’s 2023/24 financial results, check out our recent blog: EFL Championship Financial Results Season 2023/24

Turnover

The chart below highlights Coventry’s progress since their League One days. In the 2023/24 season, commercial revenue surged by 210% and matchday income increased by 40%, boosted in part by their impressive cup run.

Their total revenue of £29 million was the twelfth highest in the Championship,

Matchday Revenue

Matchday revenue is influenced by factors such as the number of home games, average attendance, ticket prices, and the club's ability to generate income from hospitality events and corporate boxes. The only exception to this is domestic cup matches, where revenue is shared between the clubs and the FA.

Coventry’s long-running disputes with the previous owners of the stadium had a severe impact on this income stream. Crowds fell to just 2,000 during the exile in Northampton and around 6,000 while playing at Birmingham’s St Andrew’s, drastically reducing revenues.

Now, with an agreement in place with the Frasers Group, the club is enjoying its largest crowds since the 1970s — clear evidence of the loyalty of its supporter base despite years of upheaval.

The Coventry Building Society Area, formally known as the Ricoh Arena, has a capacity of 32,609. In 2023/24, Coventry averaged 25,468 fans per league match — 78% of capacity — a 25% increase on the previous year and the ninth-highest attendance in the Championship. This rose again in 2024/25 to 27,812.

A remarkable cup run also boosted revenues, adding nine extra fixtures (albeit with shared receipts), which helped drive a 33% increase in paying spectators year-on-year.

Revenue per head remained steady at £14.80, roughly in line with the Championship average. Overall, matchday income jumped 40% from £7.1 million to £10 million, ranking eighth in the division.

.

Broadcast Revenue

For clubs not receiving Premier League parachute payments, broadcast revenue is made up of several components: a share of the Championship’s domestic TV deal (typically worth £3–4 million annually), appearance-based fees that can add £500,000 to £1.5 million depending on how often the club is televised, and a share of international broadcasting rights, which usually contributes an additional £1–2 million.

On top of this, each club receives approximately £5 million in solidarity payments from the Premier League, designed to support clubs in the Championship and lower leagues.

Altogether, these sources typically generate around 9 to £10 million annually for non-parachute clubs. Coventry's £10.1 million in broadcast income was slightly higher than the average due to extra TV fees received through coverage of their FA Cup matches.

Commercial Revenue

Coventry’s commercial revenue — covering sponsorships, merchandise, hospitality, stadium tours, and other non-matchday income — more than doubled in 2023/24 to £9.1 million. This surge came from a low base, as the previous year’s £4.1 million was among the lowest in the Championship.

The sharp increase was driven largely by the club bringing its retail operations back in-house, as well as the impact of an exceptional FA Cup run, which boosted both prize money and the club’s visibility.

In 2023/24, the Sky Blues’ front-of-shirt sponsor was King of Shaves, before being replaced by digital bank Monzo for the 2024/25 campaign, with King of Shaves moving to the back of the shirt.

Despite this strong year-on-year growth, Coventry’s £9.1 million total still ranked only 14th in the league for commercial revenue.

Staff Costs

Following several new signings and likely cup-run bonuses, Coventry’s player wage bill rose 30% year-on-year to £23.4 million. The £35 million invested in new players also drove a sharp increase in amortisation — the spreading of transfer fees over contract lengths — which jumped from £2.3 million to £8.3 million in 2023/24.

Coventry’s total staff costs of £31.7 million ranked just 16th in the Championship. Finishing 9th with that level of spending highlights a clear over-performance on the pitch. In fact, Coventry have outperformed their wage ranking in each of the four seasons since returning to the Championship — an impressive achievement and a testament to strong management on limited resources.

As the chart below shows, their staff costs were less than a quarter of those of relegated sides Leeds, Leicester, and Southampton, underlining the huge financial advantage provided by Premier League parachute payments.

Profit on Player Sales

Coventry generated a £23.7 million profit from player trading, largely from the sales of Viktor Gyökeres to Sporting and Gus Hamer to Sheffield United. Both had been signed for relatively modest fees before being sold at a significant premium. Gyökeres should deliver further income through sell-on clauses, following his £63.5 million move from Sporting to Arsenal this summer.

Profit and Loss

Since emerging from administration and SISU’s subsequent ‘repurchase’ of the club, Coventry have consistently operated at a loss. By the time of Doug King’s takeover, these losses had accumulated to £39 million. While not excessive by Championship standards, they still represented a financial gap that required ongoing support from the owners.

Most Championship clubs — even those boosted by Premier League parachute payments — operate at a loss. With average wage bills around £30 million, often higher than total revenue, turning a profit is virtually impossible without significant player sales.

For Coventry, wages of £23.4 million sat below the league average and represented 80% of turnover — one of the healthier wage-to-turnover ratios in the division. However, once operating costs were included, the club posted a negative EBITDA of £5.8 million, broadly consistent with recent seasons.

Increased amortisation from new player acquisitions pushed the operating loss to £14.9 million. Yet, strong player trading delivered £23.6 million in profit, while interest costs fell by £2.3 million after their loan from parent company CovCityCo was made interest-free. Together, these factors allowed Coventry to record a pre-tax profit of £8.7 million.

Coventry were one of just four Championship clubs to report a profit in 2023/24, with all of them relying on player sales to achieve it.

Player Trading

Prior to the 2023/24 season, Coventry had seen very little activity in the transfer market, both in terms of spending and sales, reflecting the club’s recent financial constraints.

That changed dramatically in 2023/24, highlighted by the high-profile departures of Viktor Gyökeres to Sporting and Gus Hamer to Sheffield United, alongside the acquisition of eight players for fees exceeding £2 million each. The new signings were Haji Wright from Antalyaspor, Milan van Ewijk from Heerenveen, Ellis Simms from Everton, Ephron Mason-Clark from Peterborough, Liam Kitching from Barnsley, Victor Torp from Sarpsborg, Bobby Thomas from Burnley, and Tatsuhiro Sakamoto from KV Oostende.

In total, Coventry spent £35.4 million on new players while generating £24.6 million from sales.

Coventry’s £35.4 million spending ranked fourth highest in the Championship, while their net transfer outlay of £11 million — acquisitions minus player sales — was the third highest in the division.

Spending continued into the 2024/25 season, with a further £20 million invested in Rudioni, Grimes, Binks, Thomas-Asante, Bassette, and Dovin.

Football Net Debt

At the end of the season, Coventry's total debt was £30 million, comprising of an interest free loan from parent company CovCityCo. This was one of the lower debt levels in the Championship.

Largely due to the sales of Viktor Gyökeres and Gus Hamer the club has £17.8 million in outstanding transfer instalments owed, while owing £12.6 million for previous player signings.

Cash Flow

Coventry do not include a cash flow statement in their published accounts.

Based on our estimates the club likely posted negative operating cash flow of around £0.7 million. They likely spent £21.4 million on new players and £6.1 million on facility improvements while earning £6.8 million from player sales, resulting in a net investment cash outflow of £20.7 million.

To cover the remaining funding gap, the club raised an additional £23.9 million in borrowings from their parent company, CovCityCo.

More broadly, in 2023/24, no Championship club reported positive operating cash flow. Across the division, total operating outflows reached £422 million, with a further £36 million in investment outflows. These were largely financed through £417 million in new funding and £41 million drawn from cash reserves.

Comments